Shorting the currency might be a wise move for investors who think Bitcoin (BTCUSD) will crash at some point in the future. The number of places and methods to short Bitcoin has increased as the cryptocurrency’s prominence in traditional finance has grown. Here are a few strategies for shorting Bitcoin.

Those wishing to short Bitcoin—that is, make money by betting opposing its price—have a wide range of investment choices at their disposal. You can have short exposure through derivatives like options or futures, as well as through margin options offered on some cryptocurrency exchanges. Bitcoin's price is erratic and prone to sharp rises and falls. Any asset has risk, but selling short is particularly perilous in uncontrolled cryptocurrency markets.

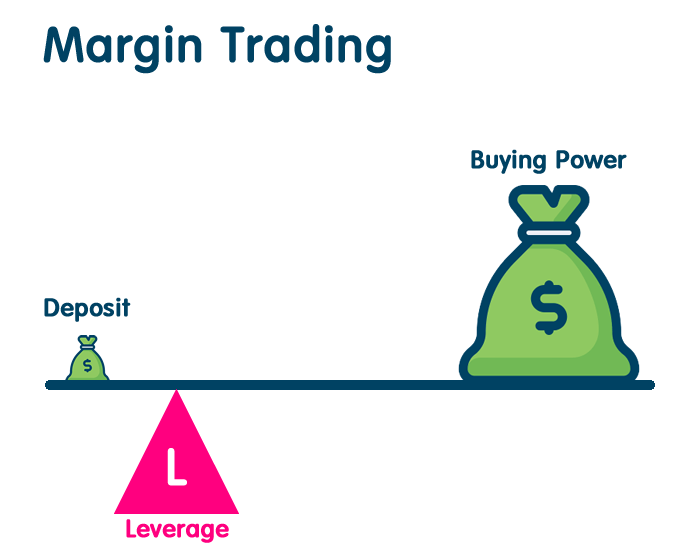

Margin Trading

Through a cryptocurrency margin trading platform, shorting Bitcoin is one of the simplest operations possible. This kind of trading is permitted on many exchanges and brokerages, and margin trades let investors “borrow” money from a broker in order to execute a transaction. It’s crucial to keep in mind that margin includes borrowing money or using leverage, which can boost earnings or aggravate losses. At current time, a number of Bitcoin exchanges, including Kraken and Binance, provide margin trading.

If you want to Buy gold Plated Coins You can visit http://coins.turkmaya.com/ or Click

Future Market

A futures market exists for bitcoin, much like other assets. In a futures transaction, a buyer consents to acquire a security in exchange for a contract that details when and how much the asset will be sold. When you purchase a futures contract, you are making a wager that the value of the underlying security will increase, guaranteeing that you may later sell it for a profit. Selling a futures contract indicates a negative outlook and a belief that the price of bitcoin will fall. By acquiring contracts that wager on a low price for the cryptocurrency, you may short Bitcoin in this situation.

Around the time of the rise in cryptocurrency prices towards the end of 2017, trading in bitcoin futures really took off. It is currently accessible on a number of other platforms. At the largest derivatives trading venue in the world, the Chicago Mercantile Exchange (CME), as well as other cryptocurrency exchanges, you may short Bitcoin futures. On well-known platforms like Kraken or BitMEX as well as at well-known brokerages like eToro and TD Ameritrade, bitcoin futures may be bought or traded.

If you have access to them, you may also trade perpetual Bitcoin futures on exchanges like FTX and BitMEX. Since perpetual futures have no expiration dates, traders can take positions and forget about them or stop worrying about rolling them.

Binary Option Trading

Traders may short Bitcoin using call and put options. You would execute a put order, perhaps through an escrow provider, if you wanted to short the currency. This implies that even if the price of the currency declines in the future, you would still want to be able to sell it at the current rate.

There are various offshore exchanges that provide binary options, but the prices (and hazards) are substantial. You may minimize your losses by opting not to sell your put options, which is one benefit binary options trading has over futures trading. Your losses are therefore restricted to the cost of the put options that you purchased. Deribit and OKEx are well-liked exchanges for trading options.

Prediction Markets

Another option to think about is shorting Bitcoin in prediction markets, where bets are placed on how events will turn out. Cryptocurrency prediction markets are comparable to those in traditional markets. Investors are able to design an event and place a bet based on the results.

Therefore, you might forecast that Bitcoin would decrease by a specific amount or percentage, and if someone accepted your wager, you would stand to gain if your prediction came true. Augur, GnosisDAO, and Polymarket are well-known cryptocurrency prediction markets.

Short Selling Bitcoin Assets

Even while not all investors may be interested in this method, those who do stand to profit if their wager against Bitcoin price is successful. Sell your tokens at a price you’re comfortable with, watch for a decline in price, and then repurchase your tokens. Of course, you might lose money or Bitcoin if the price does not change as you anticipate.

Bitcoin short sales come with significant expenses and dangers. For instance, you could have to pay custody or wallet fees in order to keep the bitcoin until the transaction takes place. The danger of the fluctuating price of bitcoin must also be accepted. You could incur large losses if the price increases (as opposed to declining, as you had intended).

Using Bitcoin CFDs

A financial technique known as an agreement for differences (CFD) distributes funds depending on the price variations between the settlement prices at the open and final prices. Similar to Bitcoin futures, Bitcoin CFDs are simply wagers on the price of the cryptocurrency. You are shorting Bitcoin when you buy a CFD with the expectation that values will fall.

Using Inverse Exchange Trading Products

Exchange-traded instruments with an inverse strategy are wagers on the price drop of the underlying asset. They are comparable to futures contracts and generate profits by combining them with other derivatives. The sole exchange-traded item accessible to Americans is the Short Bitcoins Strategy ETF from ProShares.

BetaPro Bitcoin Inverse ETF (BITI) from Canada and 21Shares Short Bitcoin ETP from the European Union are two options for investors outside of the United States.

Factors to Take into Account When Shorting Bitcoin

Like any cryptocurrency-related strategy, shorting Bitcoin carries a significant risk. When shorting Bitcoin, you need take a number of factors into account.

Volatility of the Bitcoin Price

The majority of Bitcoin shorting options rely on derivatives. These derivatives are dependent on the price of Bitcoin; changes in the price of the cryptocurrency have a cascading impact on gains and losses for investors.

For instance, since Bitcoin futures replicate movements in spot prices, they cannot be utilised as a reliable hedging against an investment in real Bitcoin. Similar to this, the volatility of the underlying cryptocurrency’s price can magnify losses in Bitcoin options trading.

Bitcoin is a dangerous investment or not?

You must consider a number of hazards while shorting a cryptocurrency, including price. Bitcoin is a young asset when compared to other, more established ones. It has only been in existence for 13 years. As a result, there isn’t enough data or information available to allow investors to make an informed choice about how it operates or if it may be a viable investment.

For instance, there are still a number of unsolved Bitcoin fork-related concerns.

New platforms could initially be “clunky” and more vulnerable to hackers, but established platforms like CME are safer and guarantee execution for Bitcoin derivatives.

Uncertainty Remains Regarding Bitcoin’s Regulatory Status

Despite its promises of worldwide coverage, it is still unclear how Bitcoin is regulated globally. American investors cannot use Deribit, FTX, or OKEx, three popular sites for trading Bitcoin.

Understanding Order Types is Required

You should brush up on your understanding of the various order types before deciding to take a short position in bitcoin. If the price trajectory deviates from your initial prediction, they might assist limit losses; for instance, utilizing stop-limit orders while trading derivatives can reduce your losses.

FAQ’s

Which Techniques Are Most Frequently Used to Short Bitcoin?

Shorting Bitcoin through its derivatives, such as futures and options, is the most popular method. Put options, for instance, may be used to wager against the price of cryptocurrencies. Another technique to short the price of Bitcoin is through a contract for differences (CFD), which allows you to keep the difference between an asset’s actual price and your predicted price. An additional method of shorting bitcoin is through prediction markets.

How Dangerous Is Shorting Bitcoin?

Shorting Bitcoin has two significant risks. Price risk comes first. It might be challenging to precisely anticipate the underlying asset’s price movement due to price volatility. The second major danger is a lack of regulation or regulatory risk. Some of the largest bitcoin futures trading platforms are unregulated. In the event that something goes wrong with their deal, investors will have fewer alternatives for remedy.

Is Leverage an Option for Bitcoin Shorting?

Many cryptocurrency exchanges, like Binance and futures trading platforms, allow users to put bets on Bitcoin’s price falling using leverage or borrowed funds. However, keep in mind that using leverage can increase earnings and losses. As a result, employing leverage entails correspondingly increased risk.

This article does not constitute a recommendation by Investopedia or the author to invest in cryptocurrencies or other Initial Coin Offerings (“ICOs”). Investing in cryptocurrencies and other ICOs is very hazardous and speculative. Before making any financial decisions, it is always advisable to get the advice of a knowledgeable specialist because every person’s circumstance is different. No guarantees or claims are made by Investopedia on the timeliness or accuracy of the information provided here.